Credit reports are documents that document the history of a borrower’s repayments. This information is used to assess the creditworthiness of a borrower by lenders. The credit report information may not be accurate. In some cases, information contained in a credit report is outdated and inaccurate.

Equifax. Experian. TransUnion all produce separate credit reports

The United States has 3 main credit bureaus. Each bureau uses its own methodology to determine credit scores. The differences are relatively small, but important. Transunion puts more emphasis on your credit history and payment history than Equifax. Apart from producing separate credit reports each bureau also offers identity protection services for consumers and other resources.

The data is collected from banks and credit card companies by all three credit bureaus. This information is then combined to create a credit report. However, not all creditors report to the three credit bureaus. Some reports may contain personal information, such as your name, Social Security number, and date of birth. Other reports don't include such personal information.

Lenders can use the information from your credit report to determine your credit worthiness

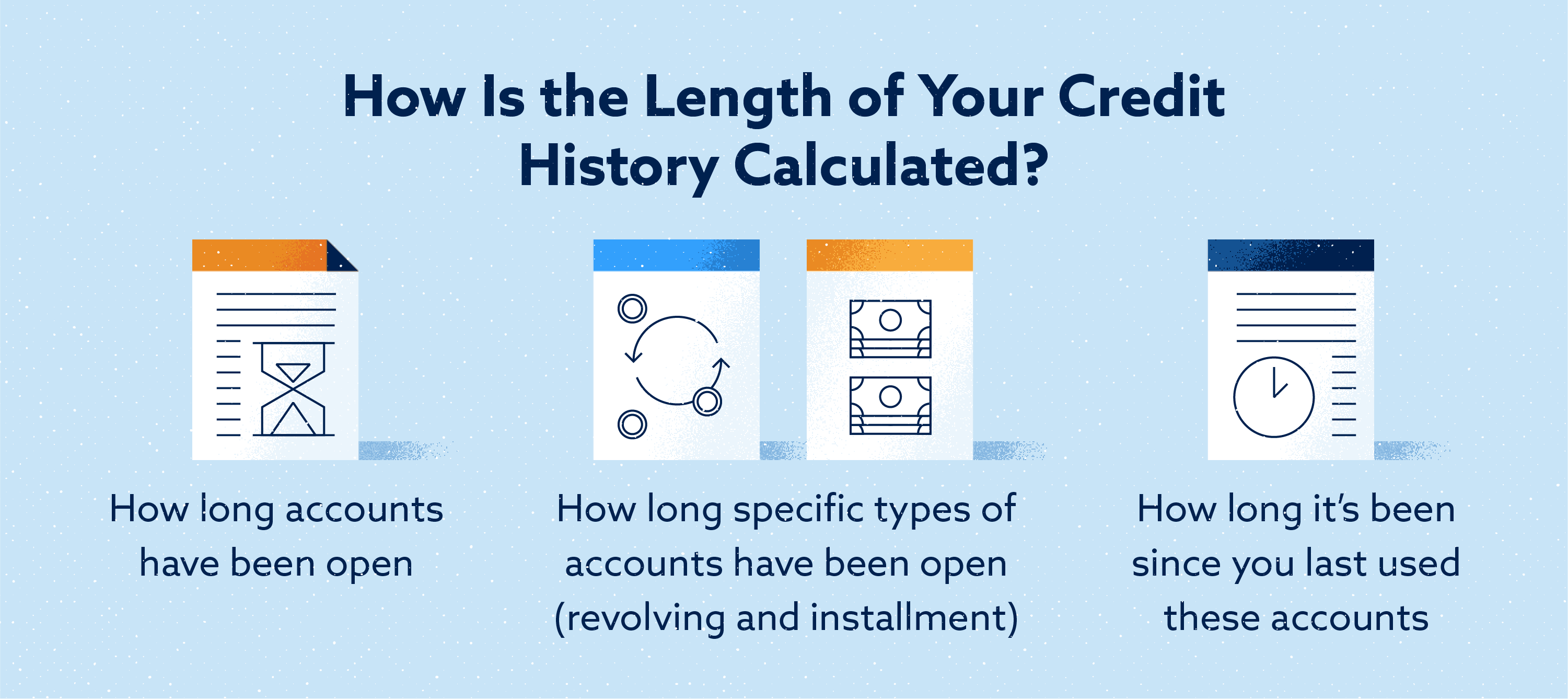

Your credit report includes details of all credit accounts that are open. Lenders use this information to determine your creditworthiness. It contains information from your lenders, yourself, and public records. Credit scores will be affected by whether you are late on payments or have made late payments.

Your credit report contains information from lenders. It includes information about account types and dates, as well as credit limit, account type and payment history. It can also contain information about foreclosures and bankruptcies. These accounts may not be reported to credit bureaus by some lenders.

Information found in a credit report are compiled by the major credit bureaus

Credit reports include details about your financial history. These details are used by lenders to make lending decisions. The credit report also contains details about your debt and your payment history. Credit bureaus compile this information to calculate your credit score.

These credit bureaus, which are separate companies, are subject to state and federal regulation. They must comply with laws such as Fair Credit Reporting Act and Fair and Accurate Credit Transactions Act. The information in each bureau's reports may differ from one another because they use different sources.

Sometimes, credit reports don't reflect the truth

A recent study found that one in five consumers have a credit report with a potential material error. Incorrect data means that lenders are more likely offer higher interest rates, to lower terms, or to deny credit. These lenders assume that the credit report system will correct the error. This system is prone to errors and can be slow, so the benefits outweigh the risks.

There are several options to prevent inaccurate information from appearing on your credit reports. Contact the credit reporting agency to request a copy your credit report. Many companies will promise to fix your credit for a fee up front, but these companies are not obligated to fix your credit for free. You can also file a complaint to the Consumer Financial Protection Bureau.

How to identify errors in a credit card report

Credit reporting errors are more common than you might think. They can lead to rejection of your credit application and high interest rates. Finding errors is easy. Simply make it a habit to regularly check your credit reports. These reports can provide you with a wealth of information about yourself and your credit history. They are also used to determine your credit score.

Credit report mistakes can take many forms. You might find an error in your name or an account you have never opened. Accounts may be linked to someone else who has the same name as you, which can lead identity theft. If you find an error on your credit report, it's important to take immediate action.