You can get a variety different credit cards for people who have good credit. These cards typically offer a wide range of benefits and rewards. Many cards offer introductory promotions, low APRs, no annual fees, or no annual fees. The average American consumer has a decent credit score, so these cards will appeal to a wide cross-section of consumers.

Preapproval

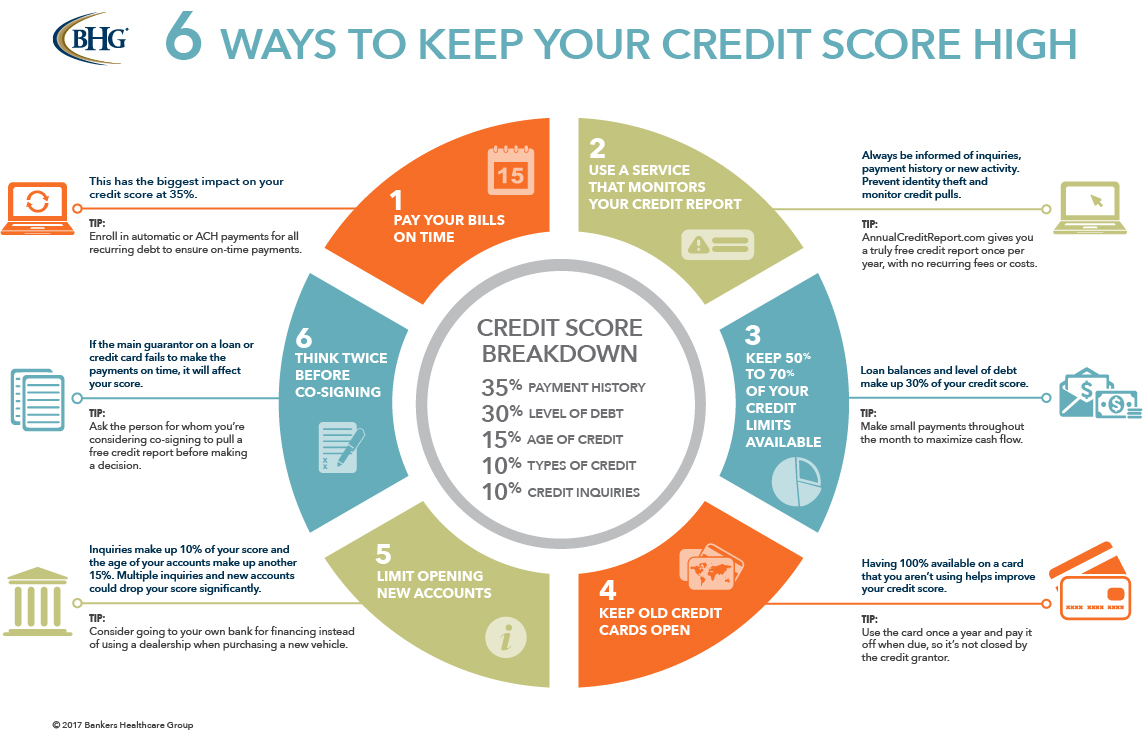

Preapproval for credit cards is possible if you have excellent credit. Preapprovals will help you avoid getting declined for cards that aren't right for you. Double-check the credit score requirements of any card issuer before you apply. It is important to review your credit report and look for derogatory marks or mistakes, as they can have a negative effect on your score.

While it's rare for credit card companies to send preapproval invitations to consumers they do occasionally. Be sure to read all the details before you sign on for an offer. Preapproval applications can be legitimate and save you the time and hassle of applying for the card.

Rewards

People with excellent to good credit are more likely to be approved for rewards credit cards. Simple: a higher credit rating means a lower rate of interest and a greater credit limit. This benefit is not worth the annual fee. You should choose a credit line that best suits your spending habits. Although sign-up bonuses are tempting, many consumers overspend in order to earn them.

You can save money by using credit cards that reward you. A few offer sign up bonuses that can be generous once you have spent a certain amount for a period of time (typically three months). Others offer travel protections and access to airport lounges.

Limits

Credit cards with high limits can boost your overall purchasing power and improve your credit utilization ratio. Credit limits are not directly related to your credit score but they are important factors that credit bureaus consider. The ratio compares your available credit to your most recently reported balances. High limit cards can be beneficial if you manage your credit responsibly and pay your bills in time.

The credit limit of a card can be higher or lower than the limit stated in its terms and conditions. A high limit card usually has a limit of tens of thousands of dollars. This limit will be determined according to your credit utilization, your income, monthly expenditures, payment history, as well as your credit history. Age is also a factor.

Annual fee

You should think about an annual fee when looking for a card. Although many cards don’t charge an annual fees, others do. Annual fees can be associated with rewards programs and maintenance costs as well as administrative costs. These fees might be worth it depending how much you spend and how often you travel.

Annual credit card fees can be a deal-breaker but they shouldn't automatically disqualify you. Numerous credit cards offer rewards and perks in combination that can offset annual fees. Before you commit, it is important to weigh the pros and cons of paying an annual fee as well as the overall benefits of the card.

Reward percentage

Different cards have different rewards percentages for credit cards with good credit. Some cards offer extra rewards such as points-funded hotel rooms. Others offer cashback. Consumers are likely to pay more for credit cards with higher rewards. You may find a lower-reward card cheaper than a traditional cash card. However, it is worth noting that the rewards you get are much less than those you receive with a card with higher fees.