An 800 credit score will help you get better interest rates and credit cards. Additionally, you will be more likely get the best offers. You need to learn some basics to improve credit scores. It is important to understand your credit score and the average age of your accounts.

Average age of accounts open

Anyone looking to improve their credit score should consider the average age of all open accounts. This account accounts for 35% to your FICO score. Your score will rise the longer you have had credit history. This also includes the amount of time you have been open a new account. A diverse range of accounts is also important as this can help improve your score.

An 800 credit score means that the average age for open accounts is 27. While this may indicate a long history of credit use, it doesn't necessarily mean you are responsible with your credit. The amount of credit you have used is less important than the time your account has been open. This can be reduced by closing existing credit cards and opening new ones. When applying for credit, it is important not to make too many mistakes.

Average age of debt

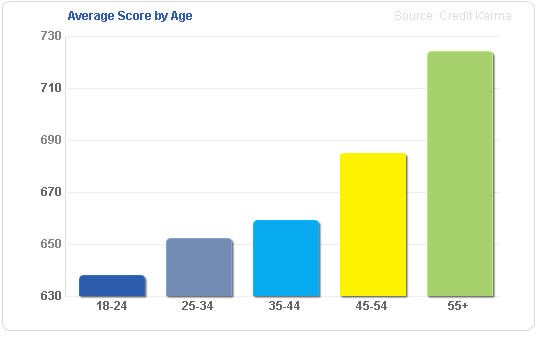

For people with an 800 credit rating, the average age at which debt accumulates is slightly over ten. Although this is low for credit scores, it is significantly higher than the average age of debt. This is due to the fact that debt peaking occurs at the age of 40, when consumers are more likely to have multiple credit accounts. The average consumer has fewer accounts by their 60s and most likely have refinanced these debts. These consumers are also less likely to have debts that exceed their credit limit. Nevertheless, there are some important factors to consider.

Understanding your debt ratio is crucial. An average credit utilization ratio (5.5%) is less likely than people who have excessive debt. This is done by taking their credit limit and divising it by the amount they have on it. This ratio can be calculated for any credit card account. An elite 800 credit score group includes those with a credit utilization ratio of 11.5%.

Average age of credit card balances

An account that is several years old may be used by consumers who have a credit score above 800. Credit accounts that are more mature than theirs have been able to be considered older. This helps with credit scores. The average age of an account is calculated by adding up the age of all the cards and dividing it by the total number of accounts. Older accounts tend to have lower average ages while younger accounts have higher average age.

People with a 800 credit score don't have large credit card balances. The average credit utilization rate for them is 11.5%. They also do not use credit cards to cover recurring, regular expenses. This makes them less likely to default on loans.

Average credit utilization rate

A person with a credit score of 800 is more likely to avoid high credit card usage. This is due to the fact they are less likely to use their credit cards and to default on loans. People with a 800 credit score have an average credit utilization rate just 11.5%.

Average debt for 800 credit scores is $138,154. Monthly payments are an average of $1,064. These consumers also tend to keep many of their older accounts open. A high credit score can increase your chances of getting better rates and terms from lenders. It may take time to build good credit.

Advantages of 800 credit scores

An 800 credit score will give you great flexibility and allow you to access the best loans and interest rates. This score also enables you to get more credit limits, increasing your buying power and making it easier to keep your credit utilization ratio low. You must be careful to maintain a good credit standing to keep your credit score above an 800-level.

A high credit score of 800 can help you get the best travel cards. These credit cards will usually offer higher credit limits and sign-up bonuses.