Check your business credit score every year. This will help you avoid any issues that could impact your financial health.

Business credit reports are a type of report that shows you your credit standing in the business world and allows you to make informed decisions regarding financing, partnerships and suppliers. These reports are also essential for small businesses to protect themselves against fraud.

Visit any of the national credit bureaus that report on business credit, such as Dun & Bradstreet D&B Equifax Experian. Creditors and lenders can use the information in your business credit report to determine whether you are eligible for credit.

Your business' credit score is a numerical value that is determined based on the information found in your business' credit report. It can be anywhere between 0 and 100%. The higher your score on the business credit report, the greater chance you have of receiving credit.

Keep track of your credit score for your business because it can have an impact on the bottom line. A high credit score for your business can help you get a loan at a low interest rate.

The size of the business and the industry can have a significant impact on your credit score. Paying on time and managing debt well can improve your score.

The information that appears on your report is collected by different companies. They use a variety techniques to evaluate payment trends and your business’s credit history. Your public record is taken into consideration, as well as the demographics of you business.

Regularly monitor your business' credit so that you can identify potential problems early and take swift action to rectify them. This can be due to inaccurate data, old information or fraud.

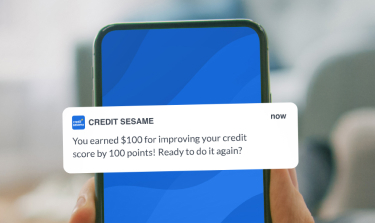

One way to stay on top of your credit is to sign up for a service that offers free access to your business credit score. These services often include a mobile app or an online dashboard that allows you to monitor your business credit and alerts you when anything changes on your score.

Nav's CreditSignal or Creditsafe by Dun & Bradstreet are just a few of the many services you can access to obtain a free report on your business credit. These services include email alerts and a range of features for monitoring your business credit.

You may want to get a report on your credit from several agencies if you own a large business. The more credit bureaus you have, the better your credit score will be because each agency has a clearer picture of your company.

If you want to order a Business Credit Report, you must first provide the name of your company and the zipcode where it's located. You will also need to complete security questions, which will help you verify that you are who you say you are.