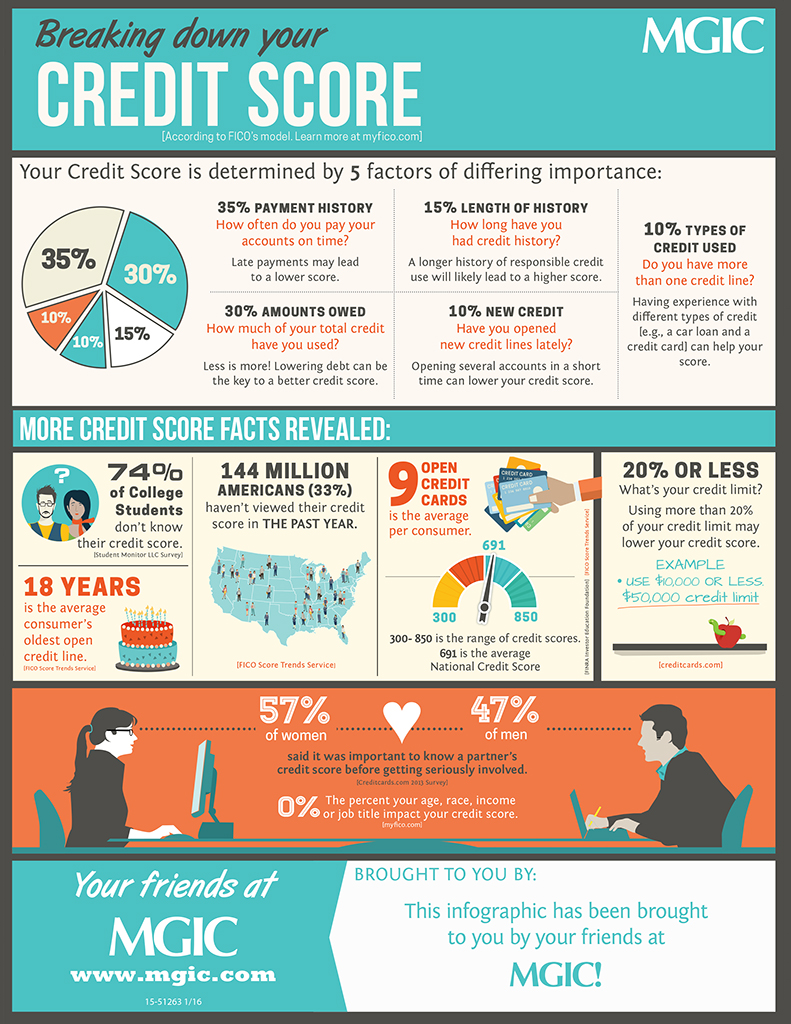

These are key factors to remember if you want a high score on your credit cards. Your utilization rate is an important factor in your overall score. Your score can be negatively affected if you don't pay your bills in time. It is important to limit it. In addition, you should pay off any charge-offs or collections you may have. Keep your credit utilization rate below 30%.

Your credit score can be negatively affected by not paying your bills on time

How timely you pay your bills is one of your biggest factors in your credit score. Some late payments will not have an impact on your credit score but others could. There are several options that you have to improve credit and avoid the negative effects of late payments. Learn more about how late payments can impact your credit score. To do this, access your credit report for free.

It is important to make timely payments if you have a creditcard. Even one late payment can negatively impact your score. Your risk of future late payments increases the longer you delay your payment. Your credit report will show a late payment for seven years. This means that you are more likely to be charged higher interest if you continue to pay late.

Collection accounts or charge-offs repaid

You can maintain good credit scores by paying off any collection accounts or charge-offs. However, it is not an easy task. Get caught up on past payments first. Once you have gotten caught up on past due payments, you can plan for your future payments. The impact of these late payments will gradually diminish over time, and you can raise your score.

Whenever possible, try to settle the debt with the original lender. As soon as possible, request a confirmation that the debt has been paid. This will appear on your credit report as a paid charge-off, which lenders generally view more favorably than an unpaid account. Likewise, if you're paying off a debt to be sold to a collections agency, you should check the details of the final payment letter to ensure that it doesn't appear on your report as a charge-off.

Keeping your credit utilization ratio low

Keep your credit utilization ratio low to increase your credit score. You can use a free service such as NerdWallet to find out how much you're using your credit. In an ideal world, this number should not exceed 30 percent. This ratio will change each time you make an purchase.

Your credit utilization ratio is calculated by dividing the amount of credit you have available to you by the total number of outstanding balances on your accounts. This number is not exact, but it can be a significant indicator of your overall score. Low credit utilization will enable you to get credit when you need it, and help you achieve your money management goals.

Avoiding asking difficult questions

Avoiding hard inquiries is critical for maintaining a good credit score. Lenders can pull your credit report if you apply or make large financial obligations. While this action may seem harmless at first, it can damage your score. Hard inquiries, which are listed on your credit report, can cause your score to drop by several points.

There are many options to avoid receiving hard inquiries. The first is to not apply too many for credit cards. You will have a lower credit score if you submit too many applications. Instead, consider whether you really need a new credit card, or if you can manage your current credit better.