A number of factors affect credit scores. Your payment history and credit utilization rate are two of these factors. These factors account for the majority of your credit score. Therefore, it is essential to correct them. You can improve your credit score by paying off credit card debt. Your payment history is also an important part of your credit report.

Negative information on your credit report

Credit score is affected by many factors, including the negative information. Lenders look at a range of factors when determining your credit score. They consider your income, length of stay at your current address, as well as the type of loans that you have. You may be able to improve your credit rating if you have a few bad marks on your record.

Any negative information on credit can impact your score. However most of this information will fade over time. Negative information includes bankruptcies as well as late payments and collection accounts. These items will appear on your credit file for seven to 10 years. This can make it difficult for you to get new credit. Most negative items will disappear in seven years. Bankruptcy information will disappear in ten years.

You have several options to dispute inaccurate credit information. Contact the credit bureau that reported the negative information first. Within one month, the credit bureau should respond. To confirm that the negative information was removed from your credit report, you may request a second copy. If this does not resolve the issue, you may want to consider hiring a credit repair company to help you.

History of payments

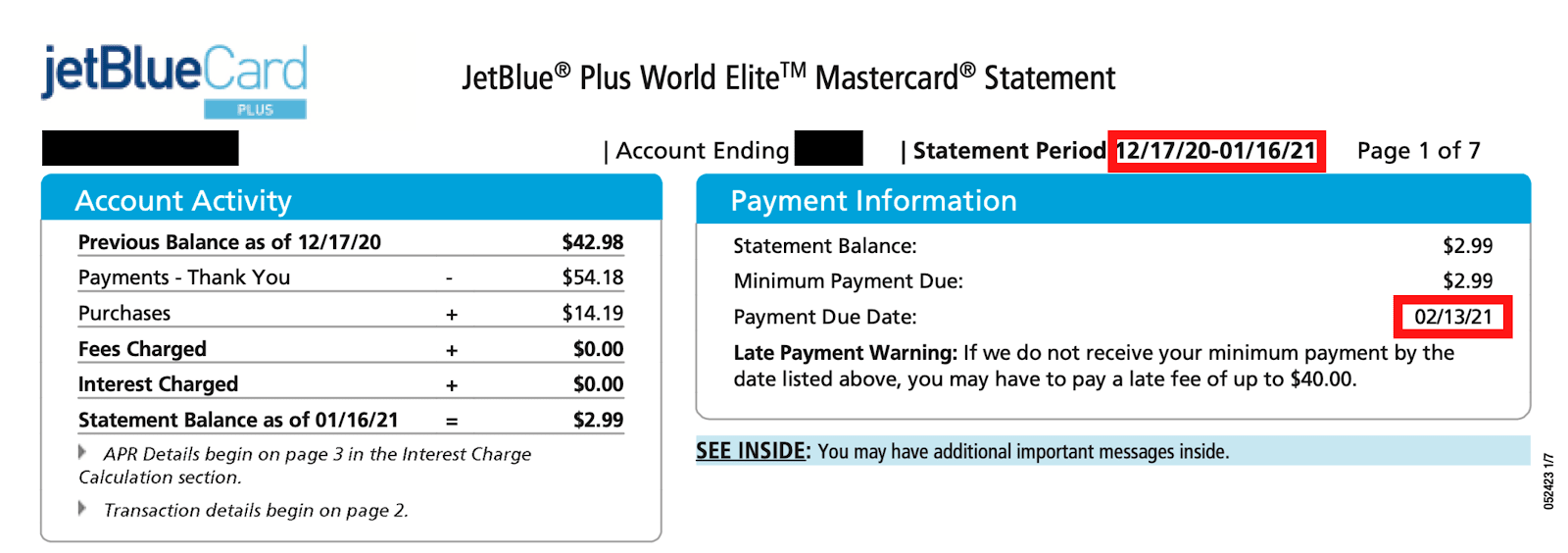

There are many factors that affect credit scores, but the most important factor is your payment record. Your payment record is a record that shows when you have made or missed payments on your debts. Good payment records are vital to your ability to obtain a loan or credit card.

Your credit score will drop if you make late payments. A positive payment history and good credit score will be achieved if all payments are made on time. While there are many factors that affect your score, this is by far the most important. Here are some examples that show how your payments history affects credit scores.

Credit bureaus compile data about your credit history. This includes late payments, judgments, or lawsuits. These data are used to compile a detailed credit history report. The payment history profile also includes a rating for each monthly. Credit score can be affected by negative information for many years.

Credit utilization rate

Your credit utilization rate (CUR), is one of the most important factors that determines your credit score. This percentage indicates how much of your credit is being used. It can either be per-account or an overall figure. Your credit utilization rate will decrease the more credit you have. Your total revolving credit balance, as well as the amount of credit card debt you have, are required to calculate your CUR.

Calculating your credit utilization is done by taking the total amount of outstanding debt and dividing it with the available credit. Although you should keep your credit utilization rate as low as possible, it is not a good idea for any account to exceed its credit limit. Overuse of credit can result in late payments that will affect your credit score.