Discover is a credit-card company that offers many credit cards. These credit cards are intended to build and repair credit. There are also rewards programs that will allow you to earn miles for travel and cash back. Learn more about Discover credit Cards here. You can use Discover without Facebook. Its privacy policies and terms and conditions are not linked to Facebook.

Discover is a credit card company

Discover is a popular credit card company, offering many credit cards. They offer a wide range of cards with no annual fees and great rewards programs. These cards are a great way of earning cash back and turning your spending into a vacation. They also help build your credit scores. Discover employs more 17,000 people. The company expects to make $5.4 billion by 2021.

The company's shares have gained more than 500 percent since the financial crisis hit, making them one of the best performing financial stocks over the past decade. Discover Financial stock is behind its competitors, and the market as a whole, but it has performed well over the last year.

You can choose from a number of credit cards that allow you to establish and rebuild credit.

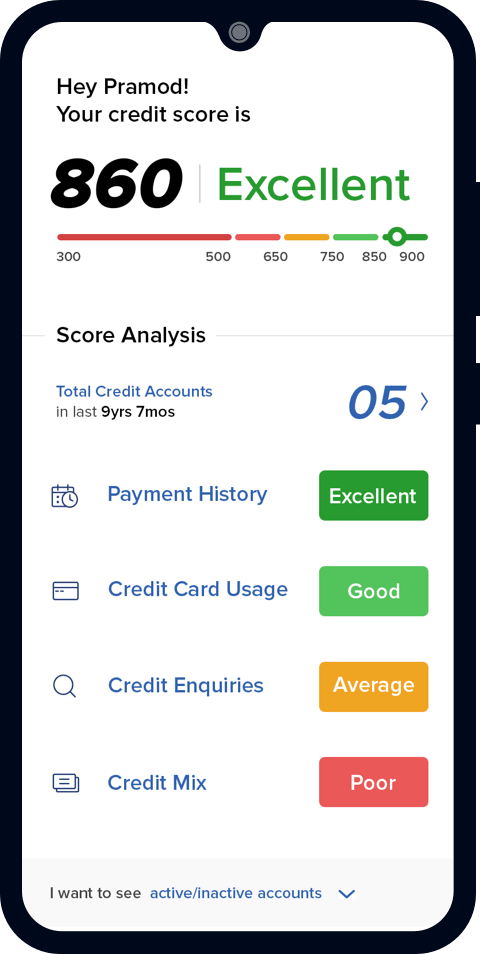

Credit cards with high credit limits and no credit limit are not recommended for those with poor credit. It is better to get a credit line with a lower balance. This will allow you to build your credit history over time and make timely payments. This will improve your credit utilization percentage and payment history. If you don't have much credit history, you should wait a couple of months before applying for a secured card. If you have good credit, you'll be able to apply for an unsecured credit card.

There are a variety of credit cards available from Discover, including a secured card that requires a deposit. This card is perfect for people who need to rebuild or build credit but are worried about putting their assets at stake. The Discover it(r) Secured Credit Card does not require a security deposit. However, once the card is paid off, it will return the security deposit.

It provides cash back rewards

Discover offers cashback rewards for credit card holders who spend less than $500 each year in certain categories. The cash back rewards vary from 1% to 5 percent depending on the category. Cardholders can also set up calendar reminders or email alerts to remind them to activate their bonus categories. Cashback rewards for purchases made outside of bonus categories are also available at 1%

Discover does away with late fees. Discover does not charge a penalty APR for late payments. This is one of very few credit cards that offers this kind of benefit. The Discover card also offers cash back rewards that will be matched by the amount you earn in the first year. This means you can receive as much cash as you wish, as long you are responsible with your card.

It allows you to travel miles

The Discover card can be a great way for you to earn miles on your travel. Points can be used to redeem for flights or hotels. You don't have spend a lot of money to redeem your points. This makes travel costs much more affordable. Your miles can be used to purchase gift cards and charitable donations.

The Discover card comes with a generous welcome bonus, which matches all the miles you earn in your first year. This means that you could earn up to $700 in travel by spending three thousand dollars with this card. The card also offers 1.5 miles per dollar which is great news for frequent travelers. And since you don't need to keep track of rotating categories, you can earn miles anytime, anywhere.