It will take time to repair a bad credit rating. This is not an easy process, but it will make it easier to get the financial products you desire. You must make sure that you don't use too many credit or debit cards to build your credit. Your credit score can be negatively affected by the number of credit cards that you have. Therefore, wait six to one year before applying for any credit cards.

Timely payment

Your payment history can be the single largest factor in your credit score. Make sure you make all payments on-time to rebuild credit. Late payments can stay on your report for up to seven and a half years, and the longer you wait to pay them off, the lower your credit score will be. Whether you have an account with one or multiple creditors, try to make two payments per month or even weekly. Your credit utilization is the amount of your outstanding balance minus your spending limit. This will help keep your credit utilization low. For example, if your credit limit was $40000, your credit utilization would be 10 percent. You should aim to make two payments each month.

A secured credit card is a good option if you have poor payment records. This type credit card allows you the opportunity to open a line of credit with a small deposit. This will serve as collateral in case you miss payments. Secured cards have lower credit limits and are intended to rebuild your credit. They usually report to all three credit bureaus which can help you improve your credit score.

Credit limits are increasing

It can help you rebuild credit. You will have more credit options and be able to purchase more. Additionally, it will increase your credit utilization. This is a ratio of how much credit you use to how much credit you have. This ratio is one of the most important factors in determining your credit score.

Check your credit score and credit history before applying for a credit increase. Lenders will automatically increase your credit line if you meet certain criteria. You may also want to sign up for a free credit monitoring service to keep track of changes to your file.

Monitoring your credit report

Monitoring your credit score is one of the most important aspects of rebuilding credit. Although it may seem overwhelming, this is a simple task that can make a huge difference in your credit score. In just a few easy steps you can drastically improve your credit score. The first step is to review all of the accounts on your credit report. You can fix any errors by reviewing your credit report. This is a free process that will improve your score quickly.

Refusal errors on credit reports can be another way of improving your credit score. It is easy to do this online, by phone or via mail. Your score can be affected by a mistake, even if it doesn't affect you immediately.

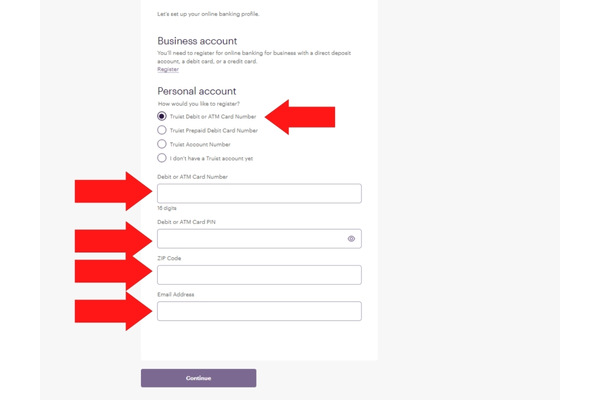

Credit card reload

A credit card can be added to your credit file to help rebuild credit. This can improve your credit score seven to fifteen points. You should only open one new bank account at once and pay your bills on time. After six months, your score will change.

You can increase your credit score by adding another credit card. This will improve the mix of accounts on your credit report. This will also improve your utilization rate. Although it may result in a hard inquiry, it will also help you rebuild credit scores. You will see a decrease in your credit score, but it will lead to a long-lasting improvement.