VantageScore, a credit score that lenders use for evaluating potential borrowers, is called a VantageScore. While credit card issuers often use it, many fintechs and installment loan lenders also use it. In fact, nine out of ten of the nation's largest banks and credit unions use VantageScore credit scores.

FICO

FICO and VantageScore scores are used to calculate your credit rating. FICO scores require at least six months of account activity to get a score. VantageScore scores don't consider the number of accounts or frequency with which you use them. VantageScore also doesn't require any minimum credit history, though it does require that you have one active credit account.

VantageScore calculations are complex, and they can differ from one lender to the next. However, both scores can help you get a better picture of your credit score. A VantageScore of 623 is considered a good credit score. It is just below the fair credit cutoff.

VantageScore

VantageScore is a consumer credit scoring system that was created in 2006 through a joint venture between the three major credit bureaus. Each of three credit bureaus holds 50% of VantageScore's management company. The credit scoring system is designed to aid consumers in making financial decisions.

VantageScore's machine learning is used to assess credit risk. This allows it to rate people with low credit histories. According to the company, it can rate approximately 30 million people. But, if credit is not your first, VantageScore might not be available for several months.

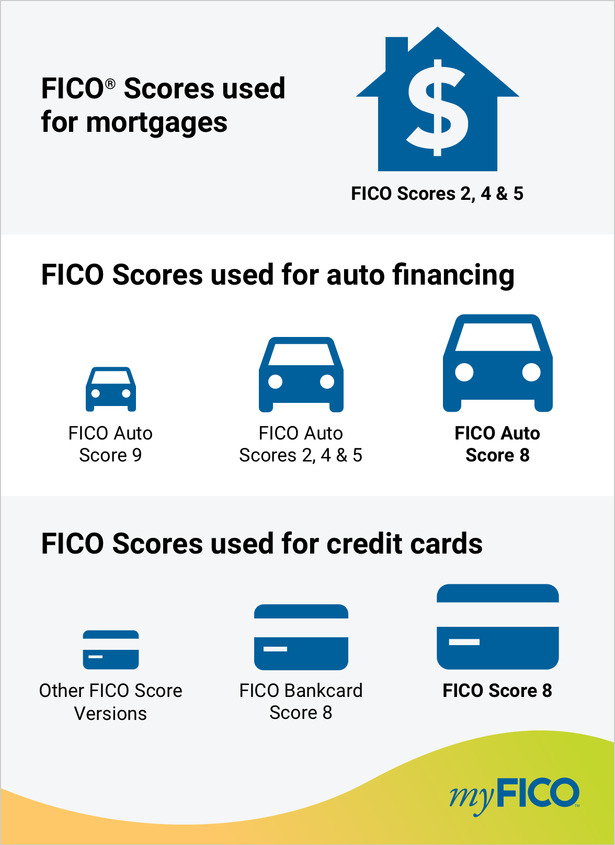

FICO 8

The VantageScore credit score is based on the same calculations as the FICO 8. However, VantageScore's weighting system differs from the FICO 8. FICO uses credit reports to calculate your score. VantageScore relies more on personal information like income and political opinions. The VantageScore also does not offer percentages for each factor, but focuses on "influential" categories.

Both FICO, and VantageScore formulas both consider payment history to be a major component. FICO's payment history is the largest component. VantageScore's payment history is third. The age of your credit history and the type of credit accounts you have also influence your score. VantageScore also evaluates your credit usage. It recommends that credit balances not exceed 30% of your credit limit.

VantageScore4.0

VantageScore 4.0, an innovative model for credit score scoring, is here. It incorporates machine learning techniques to provide scores with more accuracy. However, higher scores do not necessarily come with greater accuracy. The new model may have an impact on your score but the fundamental factors that determine your credit score won't change.

Many financial institutions such as banks and credit card issuers use this scoring system. Websites for consumers are now incorporating this system. When you apply for a rental property, you will be required to submit your VantageScore.

Tenant Data's vantage credit score

Tenant Data's VantageScore 3.0 is a new scoring system that will have a major impact on tenant screening and the rental sector. While the FICO score remains the dominant credit score in the industry, the new model is touted as a more accurate and predictive model. The new model is similar to the FICO credit score range, but it has important modifications.

VantageScore is between 300 and 800. A score of 661 is considered ideal. If the score is below 660, it means that improvements are needed. For instance, tenants can try paying down their debt and making on-time rent payments to boost their VantageScore. These past and potential rent payments are reported to the tenant's credit report. This helps them improve their credit scores.