A secured creditcard is a type credit card where you have to deposit a refundable amount before you can use the card. These cards can be used to help you get an unsecured credit card. A secured credit card will require you to make a minimum deposit. You should be careful about how much you spend. These cards can only be used for a limited amount of purchases each month. You must also make timely payments.

Secured credit cards require a refundable deposit

You can apply for a secured creditcard if your credit score is good and you are prepared to make a small deposit. A small deposit of $250 can give you greater control over your cash flow than a larger amount. The security deposit cannot be refunded and it may prove difficult to get it if you have an emergency. If you are unable or unwilling to pay your monthly bills, your card may be cancelled.

If you have no credit or bad credit, secured cards are an excellent option. Many of these cards do not conduct a credit check, but they may have higher fees. To receive a refund, you'll need to submit information about your bank accounts to the credit card issuer. In some cases, the issuer will give you a statement credit for your new unsecured card.

These cards can be used to help you get an unsecured credit card.

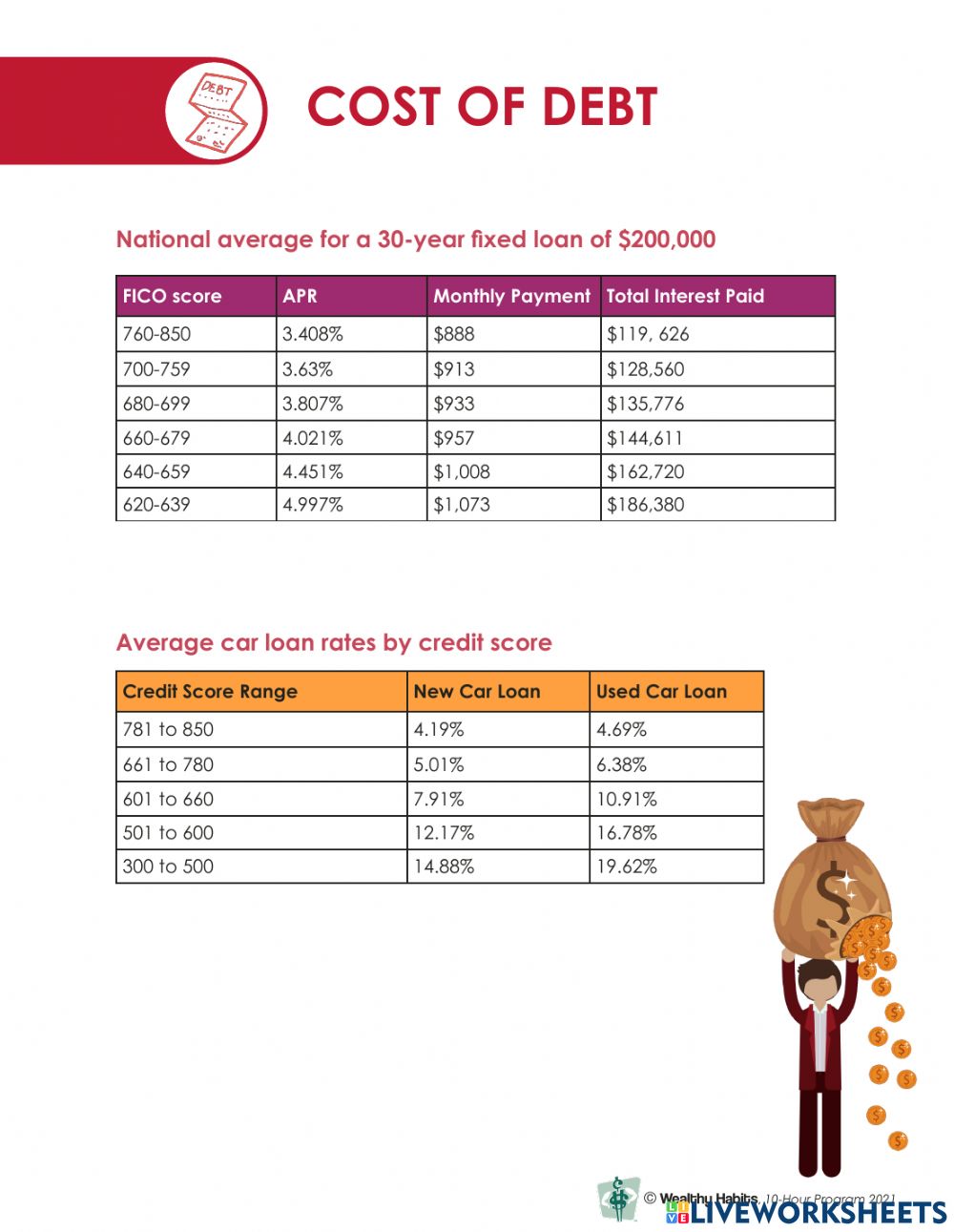

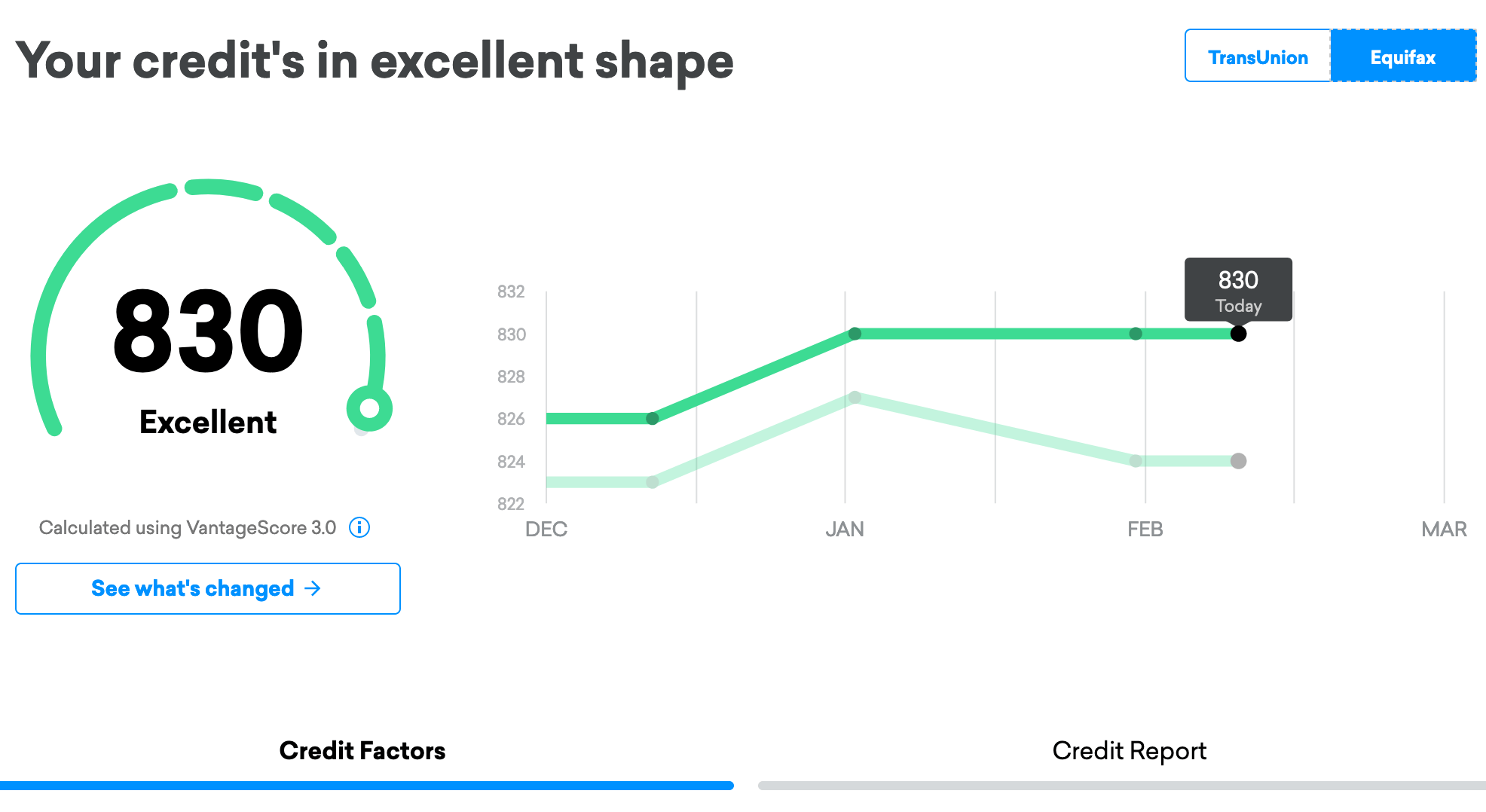

Upgrade from a secured to an unsecure card by making regular payments for a specified period. This will build your credit score to a level that will qualify you for an unsecured credit card from your card issuer. A credit score of at minimum 580 is an ideal requirement. Additionally, your credit utilization ratio should be less than 30 percent.

Secured credit card cards are great for building credit and helping to develop good credit habits. You should remember that these cards will not be a permanent solution to fixing your credit. Many people upgrade to an unsecure credit card eventually.

These are proof that lenders require a strong credit history

Secured credit card cards are one of many ways to establish your credit score. A majority of secured card issuers will refuse to issue you a credit card if your income is low or you've had bankruptcy. Bankrate's CardMatch tool will help you verify your eligibility.

Some secured credit cards allow you to automatically increase your credit line after making on-time payments. This gives you more purchasing power and raises your credit score. Lenders consider FICO scores above 670 to be "good".

They are also more accessible than unsecured card

You might consider a secured credit line if you're looking to improve credit. These cards are more accessible than unsecured. These cards require you to deposit money that will be held by the issuer in order for them to cover any unexpected costs. These cards are better for people with poor credit as they can help them rebuild their credit history.

Unsecured card are harder to get and can pose greater risks. If you have bad or no credit, you may find it difficult to get approved, even for a small line of credit. High non-refundable fees may be required. This could lead to an account with an interest rate that is higher than your credit rating.

They can help to build credit

Secured credit cards are a great way to start building a good credit history. These cards can report your monthly information to credit bureaus and help build a solid credit history. A secured card can help you build credit by making timely payments and not missing any payments. If you have an open account, you can build credit quickly.

Secured credit cards can help build credit if you learn how to manage them. Keep your monthly payments on schedule and do not spend more than 30% of the credit limit. Secured credit cards can also be useful if your credit is not good and you're trying to rebuild it. They report to the credit agencies each month and have very low annual fees. There are very few annual fees for secured credit cards.